The way you predict USD is the same as how you indicate EURO/USD; the difference is that it is a pair currency, which means you must constantly check the rate because it is the most popular pair in the trading industry. If you want to be successful in your trading, make sure you always know how to predict the rate of the two. Here are the things you need to know about predicting the EUR/USD rate, according to SmartyIndian:

- Make sure you know what kind of analysis you’re going to do first because there are many various types of analysis, all of which are valuable, but some of which are unrelated to the kind of trading you’re doing. Fundamental analysis, technical analysis, and sentiment analysis are the three types. Fundamental analysis looks at current events and predicts the long-term direction of your currency based on the news, technical analysis looks at the price movement, and sentiment analysis looks at how other traders are feeling right now.

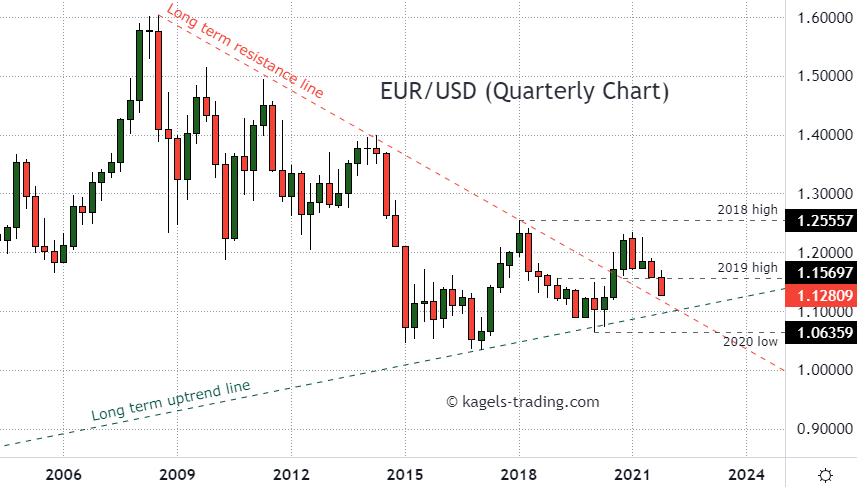

- Make sure you’re using and looking at the appropriate charts; otherwise, you’ll wind up making a bad transaction or losing money. When looking at charts, make sure you choose what your broker recommends and is legitimate.

- Make sure you don’t just jump in when it comes to trading because every trading currency has its own correct time to trade, and if you pick the perfect moment for you, you’ll be successful.

- Make sure you understand how to spot trends. Examine your charts to see if the price has moved seven times higher and two times downwards. Then you’re most likely dealing with an upward trend. Since this is required, use trendlines and practice. Knowing how to read a chart correctly and identify what is truly going on is beneficial.

- Traders have distinct habits that tend to repeat themselves over time, and your charts can reveal this information if you know what to look for. Make sure you can detect the exact forms and patterns that give you clues about what can happen next. Also, you don’t want to open a BUY position in the final few candles before a significant price drop. On the contrary, you want to be able to ride the trend when it’s at its peak, not when it’s on its way out. Use an indicator or look at the size of the candles.

- Traders have distinct habits that tend to repeat themselves over time, and your charts can reveal this information if you know what to look for. Make sure you can detect the exact forms and patterns that give you clues about what can happen next. Also, you don’t want to open a BUY position in the final few candles before a significant price drop. On the contrary, you want to be able to ride the trend when it’s at its peak, not when it’s on its way out. Use an indicator or look at the size of the candles.

- If you don’t have the most acceptable individual to share or trade with, you can wind up getting scammed or losing all of your money for nothing. If you want to know more about USD/EURO predictions, you can check it at SmartyIndian.