Latest Education News

Easily Split Large PDF Files with GogoPDF

The rise of e-commerce and online learning setup are forms of disruptive…

First First Day of School: How to Get Your Child Ready for Kindergarten

You did it, parents. You got through the grueling newborn and toddler…

Should You Hire a Professional Resume Writer?

Did you know that 40% of hiring managers spend under 1 minute…

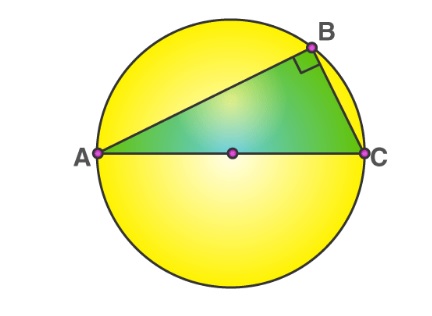

What do the Terms Perimeter and Area of Semicircle Signify?

Geometry is the observation and study of shapes and about their properties.…

What is GCF? How to find the GCF of two numbers?

A factor is a number that, when multiplied by other numbers, produces…

Reason to Choose Temporary School Buildings

Although schools have traditionally used only permanent buildings, nowadays the use of…

12 Smart Tips for Government Exams Preparation

In India, a wide variation of government jobs and vacancies are released…

Your Step-By-Step Guide to Finding the Perfect Freelance Writing Niche

Did you know that in 2019, 131,200 people worked as an author…

Educate kids on the difference between equity and fairness

Most kids tend to shout 'it is not fair,' especially when they…